Page 2 of 2

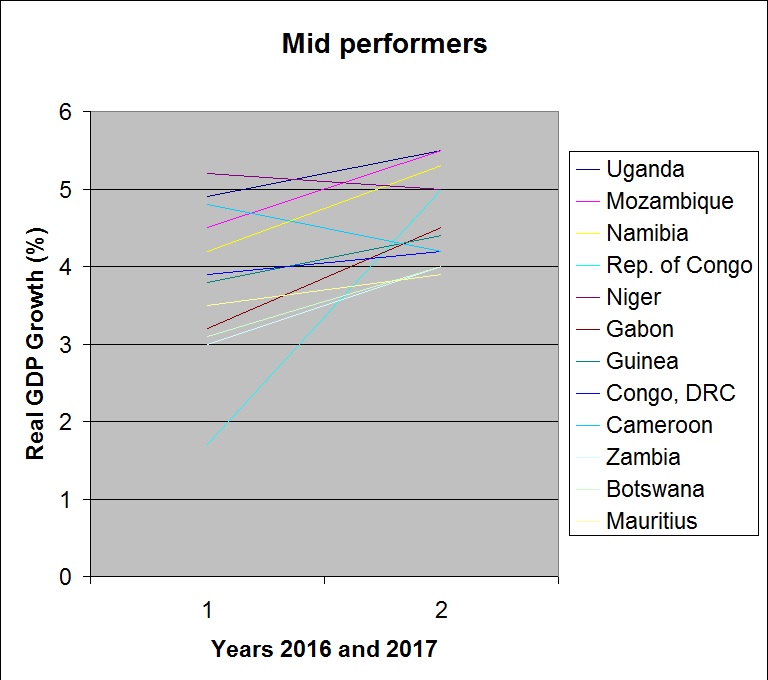

Mid-performing countries

These countries are dependent on resources, services and manufacturing sectors such as Cameroon, Zambia and Uganda where growth is expected to be supported by public investment and business reforms. This is alongside reforms in energy sectors as new capacity energy sources come online and some extract-related projects are implemented.

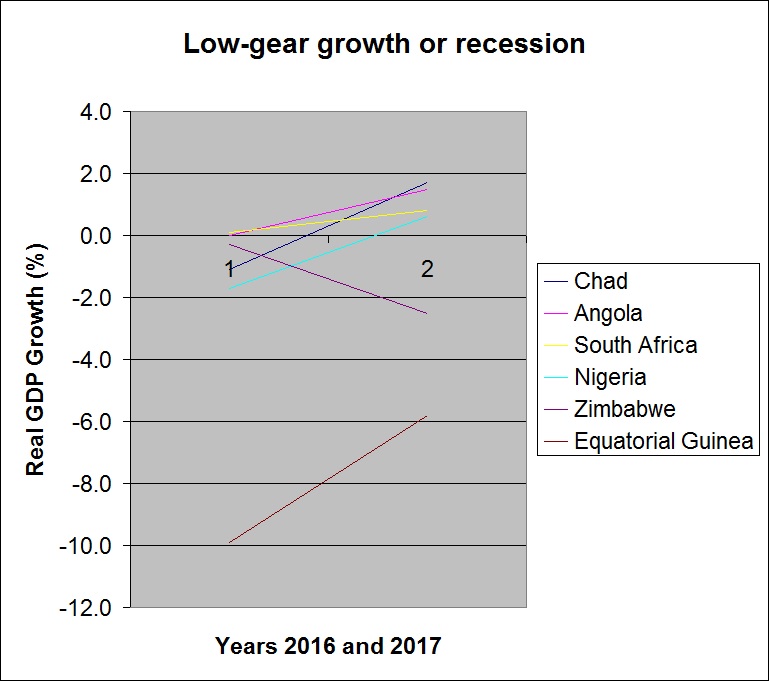

Weak growth or recession

Oil exporters such as Angola, Chad and Nigeria have suffered recently, as well as non-oil exporting South Africa, as cuts in public spending, lower imports and rising inflation affect the economy. Policy uncertainty and structural log jams (especially in power generation) have had a negative effect on South Africa in particular. A small growth is likely for the oil exporting nations, even if the crude price rises slightly to an average US$55 per barrel. This would help fund vital public projects and increase bank credit to the private sector.The IMF explained: “The largest countries are expected to return to only very modest positive growth rates and other resource-intensive countries to register marginal improvements in their outlook, others will continue to be propelled forward by ambitious public infrastructure plans and dynamic private sectors.”

Countries with stable growth have seen fiscal deficits widen and debt levels expand in recent years. In those countries with limited buffers on development spending cuts, the IMF urges striking a better balance between increased investment spending needs and debt sustainability.

Growing divergence

2016 was a tedious year for the global economy with a variety of reasons causing difficulties for a number of countries in Sub Saharan Africa. Commodity prices took a hit with the drop in oil price. China bought less from Africa as more and more commodities were being made in China or bought from either the European Union or the United States. Volatility in the global capital markets made Sub Saharan Africa unattractive for foreign investors and as a result, the figure of FDI levelled off. The construction sector has also taken a blow as infrastructure spending was reduced in many nations.Capital expenditure has doubled over recent years, but a growing population and increased industrialisation presents its own challenges. The World Bank estimates Africa will need US$100bn per year to close the infrastructure-financing gap.

Despite these challenges, strong demographics, infrastructure development and an abundance of resources will ensure Sub Saharan Africa has a positive future.

The World Bank expects urban growth to make a tangible contribution to GDP over coming years, with the share of Africans living in urban areas rising from one in three in 2010 to half by 2030.

The factors that make Africa favourable to investors in the first place are largely intact. A new Ernst and Young report agrees with this. “We have witnessed a structural evolution rather than cyclical change that marked previous boom and bust periods. Although exports remain commodity-oriented, private consumption has become a key growth driver, as has investment in infrastructure. The services sector constitutes an increasingly significant proportion of most economies and the role of manufacturing is increasing. However, most African economies are in a fundamentally better place today than 15 to 20 years ago.”

In conclusion, Sub Saharan Africa should remain the world’s second fastest-growing region (after emerging Asia) in the period to 2020, the IMF estimates.