IDTechEx’s new report, ‘Battery Markets in Construction, Agriculture and Mining Machines 2024-2034’, showed that CAM machines require a diverse range of battery solutions to cater to their individual needs

It has taken around 15 years to convince car owners that battery power is a viable alternative to their fossil fuel comfort blanket. In the construction, agriculture, and mining (CAM) industries, electrification is an even steeper uphill battle. In these industries, if a machine runs out of battery, the operators will soon start losing money. Moreover, these industries have a broad spectrum of machines, each with unique use cases. In case of agriculture machines such as tractors, electrification presents some unique challenges.

Energy consumption

The first challenge is that the use case of tractors is incredibly energy-intensive. For the most part, the purpose of a tractor is to drag machinery through a field. Sometimes, this work is low intensity, such as mowing grass in large fields. Here, the mower attachment isn’t too heavy and creates little resistance with the ground. On the other hand, plowing a field creates lots of resistance and, therefore, uses lots of energy. Additionally, if a field has soft mud, the tractor will lose energy due to the tires slipping. When we compare a tractor and an excavator for example, although both machines have hard and similar workloads, the excavator is at its peak load only momentarily as it breaks through the ground while a tractor works at a constant near-peak capacity. From a battery standpoint, this means that the tractor needs substantially more storage to give the same run time.

Chassis size

While large construction machines have large chassis to incorporate the battery, tractor chassis are a little more compact. Additionally, large excavators can handle the weight of the battery, with many already having concrete ballasts for balance. Excessive weight however, could be an issue for tractors, especially when operating in wet mud. Tractors are also more sensitive to the location of the weight, preferring an even weight distribution across the wheels for the best stability in the mud. So, not only do tractors need more battery power per hour than other similarly sized CAM machines, but they also have tighter constraints on where that battery can go.

Uptime

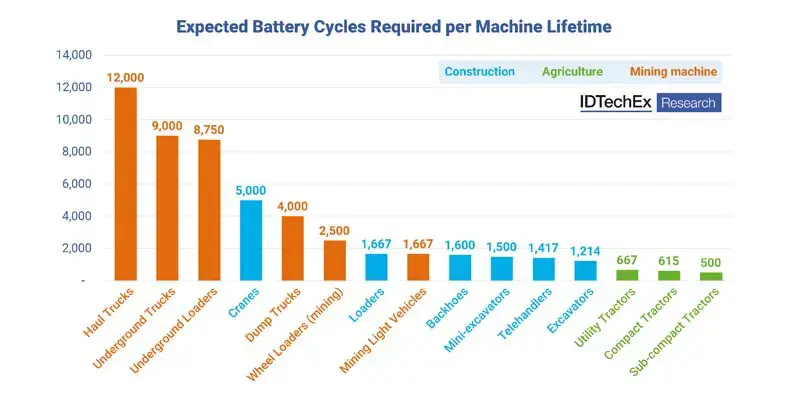

Construction and mining machines tend to be in almost constant use, but many tractors have very seasonal work. They could sit dormant for large portions of the year, but come harvesting time on a large farm, they could be running 24/7 for days at a time. High uptime in peak season means that the battery needs to be capable of rapid charging to minimise downtime. This is typically tough on batteries, as regular fast charging can degrade their cycle life. However, on the positive side, sporadic usage means fewer cycles are needed over a vehicle’s lifetime. Many tractors have life expectancies of around 2,000-5,000 hours, whereas large excavators might operate more than 10,000 hours over their life span. A shorter life expectancy, with fewer cycles required, opens up battery options to more cutting-edge and emerging technologies.

Battery technologies

Today’s dominant battery technologies are Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP), used almost ubiquitously throughout the automotive industry. NMC offers good energy density but typically recharges slower compared to LFP. LFP has compromised energy density but is cheaper and can be recharged more quickly. Both have plenty of cycle life for agricultural applications, but IDTechEx suggests that other emerging options with higher energy density could offer a better fit.

Solid-state batteries (SSBs) and silicon anode batteries are two emerging technologies that might work well in tractors. Both offer improvements in energy density when compared to NMC and LFP, making it easier to put more kWh of battery capacity onto the tractor. Both offer good to high recharging performance, minimising downtime. Finally, both offer the equivalent or higher safety than LFP and NMC. Unfortunately, both technologies are also very new, still in the early stages of commercialisation, and therefore are very expensive. Solid-state batteries and silicon anode batteries make a good fit for agricultural machines from an engineering perspective, but unfortunately, they don’t quite make the business case, for now.

IDTechEx’s report considers a total of 15 machine types across construction, agriculture, and mining, evaluating the needs of each and matching them up against ten existing and emerging battery technologies. The report forecasts that SSB and silicon anode will have a small market share of battery demand for agricultural vehicles once they are more mature, but demand will still be dominated by NMC and LFP, even in 2034.